KUALA LUMPUR, 23 July 2021: The Vehicle Theft Reduction Council of Malaysia (VTREC) embarked on vehicle theft engagement related to auto frauds and scams, organised a live webinar entitled “Protect Yourself from Auto Frauds and Scams” for all Malaysian. The webinar was hosted by VTREC as part of VTREC’s role in engaging the stakeholders in combating the vehicle theft crime in Malaysia other than creating awareness towards the public on this particular crime and this time touching on an uprising matter regarding online frauds and scams crime.

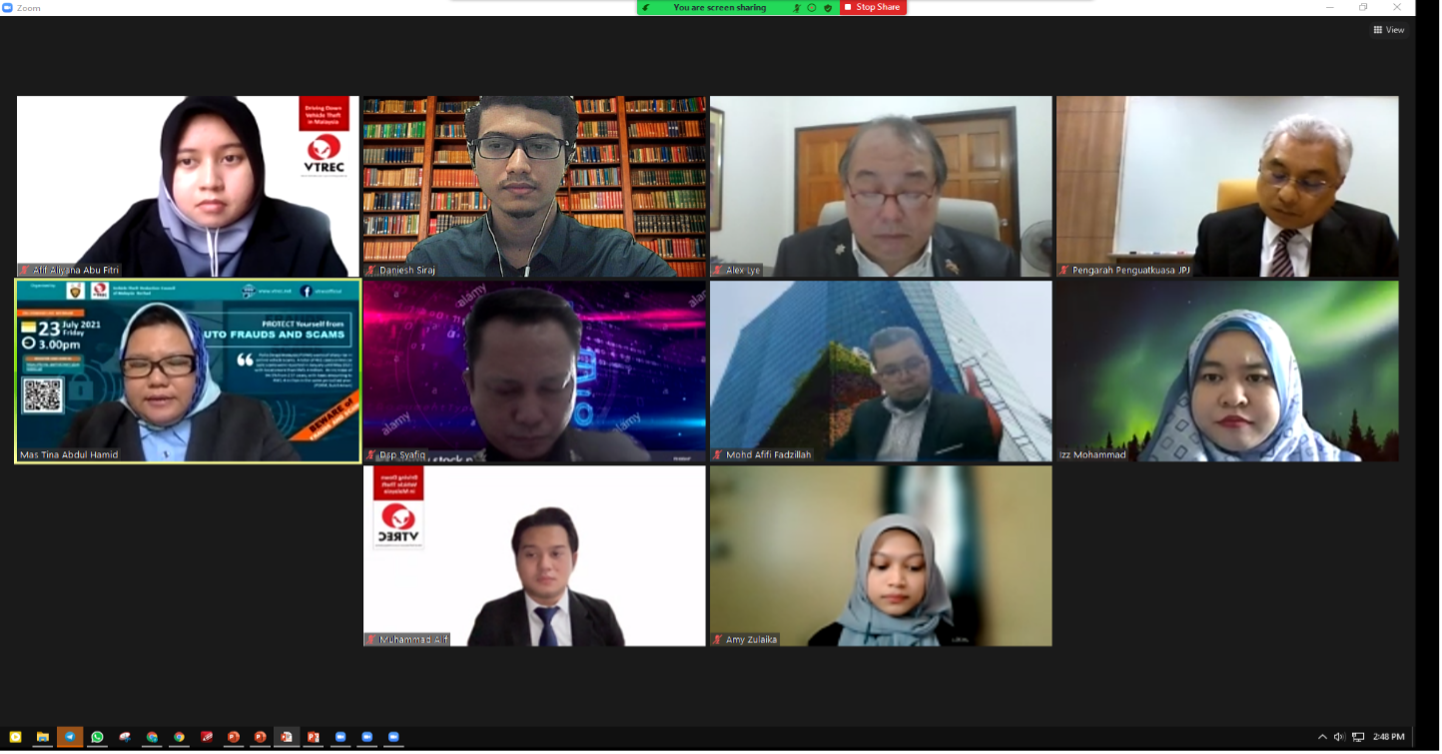

Moderated by Puan Mas Tina Abdul Hamid – VTREC Co-Ordinator.

The moderator of the event Puan Mas Tina begins the session by welcoming all the participants, a brief introduction, highlighting the objectives of the webinar and housekeeping of participants. In the introduction, the moderator also captured the participant’s attention by bringing forward the uprising number of cases involving auto frauds and scams as she says “throughout 2020 last year, a total of 678 cases of vehicle scams involving loses of RM5.9 million according to Bukit Aman, and this year from January to May alone, 461 cases of online car scams were reported with loses of over RM5.3 million. It is a nightmare as the drivers fall for online scams amid Covid-19”.

Among the participants of the webinar

The event’s aims were to create awareness to the public on auto frauds and scams. The line-up of panelists from different yet important agencies in the field of auto frauds and scams sharing their discussion on various topics from various context in regard to the statistics and number of cases for auto frauds and scams, the current situations in Malaysia, documentation falsification and the increasing number of cloned vehicle on the road, the coloration between auto frauds and scams with the pandemic covid-19 in a global point of view and also the effects of auto frauds and scams to the insurance ecosystem.

Moderator’s final briefing to all panellists and technical team.

The panelists line-up were YDH Tuan DSP Mohd Syafiq Jinuin bin Abdullah, Pegawai Penyiasat Kanan, Bahagian Jenayah Siber, Jabatan Siasatan Jenayah Komersial, Polis Diraja Malaysia(PDRM), YBhg Datuk Lokman bin Jamaan, Pengarah Bahagian Penguatkuasa, Jabatan Pengangkutan Jalanraya (JPJ), YBhg Dato’ Alex Lye President of International Association Auto Theft Investigator, Asia Branch, and last but not least, Encik Afifi bin Fadzillah, Manager, Motor OD EPAR Centre & Theft, Etiqa General Insurance Berhad.

YDH Tuan DSP Mohd Syafiq Jinuin bin Abdullah, Pegawai Penyiasat Kanan, Bahagian Jenayah Siber, Jabatan Siasatan Jenayah Komersial, Polis Diraja Malaysia (PDRM)

The First Panelist, YDH Tuan DSP Mohd Syafiq Jinuin bin Abdullah whose current research is on online frauds and scams involving vehicles, speaks about the statistics to give a clear picture on how serious this particular crime is. He shared the number of total cases since last year and the amount of lose involved for each month. The numbers were surprisingly significant and he said that one of the factors could be due to the pandemic as the number kept rising after the government announced the Movement Control Order (MCO) in March last year. Tuan DSP Mohd Syafiq during his session also shared the possible platform used by criminals for online frauds and scams. The number one most frequently used for social media is Facebook while most used online site are Mudah.my. He then shared the number of cases and amount loss for each category of goods where vehicle is placed second having most number of cases and huge sum of loss. Towards the end of his sessions, he reminded everyone to beware of scammers when making online purchases and to not make hasty decision when making online purchases especially when buying items that are usually purchased face to face such as vehicles.

YBhg Datuk Lokman bin Jamaan, Pengarah Bahagian Penguatkuasa, Jabatan Pengangkutan Jalanraya (JPJ)

YBhg Datuk Lokman bin Jamaan, Pengarah Bahagian Penguatkuasa, Jabatan Pengangkutan Jalanraya (JPJ), the second panelist with his vast experience of 35 years being in the government sector, started off by sharing what is meant by cloned vehicle, its definition, how does it affect the road user, what are the enforcement implemented by JPJ for these cloned vehicles including what are the acts violated in related to cloned vehicles. Datuk Lokman said that one of the major errors is that cloned vehicles are not protected by insurance, which not only endangered the driver itself but also other road users. He then shared the common vehicles that are involved in this kind of crime. Speaking through JPJ’s experience, most of these vehicles come from Singapore, these vehicles usually are vehicles that have short or limited duration of time in their certificate of entitlement in Singapore, therefore just before the certificate expire, they will smuggle the vehicles to Malaysia and then cloned as a registered vehicle in Malaysia. Due to this, he said that JPJ has been taking a few initiatives to reduce the number of clone vehicles in Malaysia, they have implemented vehicle verification system for all vehicle travelling in from Singapore and a biometric system was enforced for changing of vehicle ownership. Before ending his session, Datuk Lukman mentioned that most of the time, buyers are actually aware that there’s something wrong with their purchasing when the price are lower from the market price, the documents are not complete and the legal process are not met. Hence, he reminds that most importantly, every individual should play a role in stopping this crime of vehicle cloning from happening.

YBhg Dato’ Alex Lye President of International Association Auto Theft Investigator, Asia Branch

YBhg Dato’ Alex Lye President of International Association Auto Theft Investigator, Asia Branch

The third panelist, YBhg Dato’ Alex Lye when asked what are the coloration between the auto fraud and scams with the global pandemic Covid-19 from the global perspective, he shared how very concerning the pandemic that are affecting every aspect of our lives especially economy. He said that a study done by MITI predicted 9 million jobless people in Malaysia by October this year. He then said that when people are jobless, they could go to the extent of being a fraudster or scammers in order to survive. Dato’ Alex shared a few real-life examples that happened globally to set a clearer picture on what he meant by people are prone to fraud and scams that involves either between individuals or with insurance companies. In the last part of his sessions, Dato’ Alex Lye shared three recommendations on ways or strategies that could curb or prevent the increasing of auto frauds and scams. The first way is to deal with fake vehicle parts, one of the ways is to actually microdots all the parts from the original manufacturer before it is distributed to the stockists. Secondly, is to update the vehicle security system to the current standard which is used worldwide and thirdly, to look into vehicle cyber-crime as it has been happening all around the world and it will come to Malaysia soon.

Encik Afifi bin Fadzillah, Manager, Motor OD EPAR Centre & Theft, Etiqa General Insurance Berhad.

Encik Afifi bin Fadzillah was the fourth and last panelists, as a representative from the industry shared the modus operandi commonly used by fraudsters and scammers to trick insurance companies, their motives and what are the entities involves. He said that fraudsters would usually use a ‘project car’ most probably a clone vehicle to get an insurance policy and then they would create an incident that could give them the opportunity to claim for insurance. There are five entities that could be involve in this type of frauds, they are the insurance agents, workshops, claim examiners, vehicle owners and defendant lawyers. Encik Afifi shared there are two types of fraud known which are hard fraud and soft fraud. Hard fraud is when the fraudsters deliberately plan or invents an incident that is covered by their insurance policy in order to claim payment for the damage, while a soft fraud refers to as opportunistic fraud involved policy holders exaggerating otherwise legitimate claims. Before ending the session, he shared a few methods used by the insurance industries to actually detect frauds and these methods are used to overcome and curb the issue of auto frauds and scams.

Among the Participants of the webinar

Among the participants of the webinar

The event ended smoothly with almost 300 participants joining in the zoom meeting room as well as joining through the Facebook Live. During the event, there were many questions forwarded by the participants for panelists to answer among others were about how to differentiate a genuine call from a scammer, what kind of system are the police using to detect stolen vehicles, can the implementations of e-plate help to reduce auto frauds and scams and many others. Participants were very active throughout the whole webinar session asking questions which shows attentive listening to all the sharing that have been put forward by all the panelists. The webinar came to an end with a Group Photo session after all the panelists have said their final words and a simple wrap up from the moderator.

VTREC thanked the panelists and all participants for their collaboration and their active participation for making the webinar a success.